The world of investment planning can often seem daunting to those just starting out. With so many options available and various aspects to consider, it's easy to feel overwhelmed. Fear not, as this beginner's guide will provide you with an essential roadmap to navigate the world of investment planning, helping you create a well-structured plan that will secure your financial future. By following these steps, you will be well on your way to becoming a savvy investor.

Jason Shaw

Recent Posts

A Beginner's Guide to Investment Planning

May 5, 2023 3:45:00 PM / by Jason Shaw posted in Financial Planning, Investments

Saving for Retirement on a Modest Income

Apr 13, 2023 11:00:00 AM / by Jason Shaw posted in Financial Planning, Retirement

Saving for retirement is particularly challenging for those living on a modest income. You may feel as though there isn’t any money left after covering your basic expenses each month. Even if you manage to put away a few dollars, investing in an IRA often involves an initial deposit of at least $1,000. Low- to moderate-income earners do have some tools available to help them get started, however. If you have found it difficult to begin saving for retirement, these tools and incentives can help.

Retire With Confidence: A Guide to Retirement Planning

Mar 2, 2023 10:15:00 AM / by Jason Shaw posted in Retirement

Retirement is one of the most important milestones in a person's life. It is a time when you can finally relax, travel, and enjoy your hard-earned savings. However, retiring with confidence and financial stability requires careful planning. Retirement planning is a crucial aspect of personal finance. It is the process of setting goals, developing strategies, and making decisions to ensure you have enough income and assets to sustain you throughout your retirement. Many people today face the prospect of retiring without adequate planning and preparation. As a result, they risk running out of money in their golden years.

Owning a Rental Property in Des Moines

Oct 29, 2021 10:15:00 AM / by Jason Shaw posted in Financial Planning, Investments, Property

If you're thinking of investing in real estate in Des Moines, Iowa, owning a rental property can be a great option to generate passive income. However, it's not as simple as just buying a property and renting it out. To be a successful landlord in Des Moines, you need to be well-informed about the local real estate market, organized, and prepared to handle various challenges that may arise. In this guide, we'll share valuable advice to help you make your rental property business a success.

Tips for Creating Financial Goals

Oct 7, 2021 11:06:24 AM / by Jason Shaw posted in Financial Planning, Investments

Setting financial goals is an essential step toward achieving financial stability and security. Creating achievable financial goals requires deliberate planning, discipline, and a clear understanding of your financial situation. This article provides tips on how to set financial goals that are realistic, achievable, and sustainable.

Positioning Assets for Financial Aid

Sep 23, 2021 2:53:01 PM / by Jason Shaw posted in Financial Planning

If you have a dependent who is planning to use financial aid for college, you might want to consider meeting with a financial advisor to create a plan for your assets ahead of time. Financial aid is mostly awarded based on need, so your assets could hinder your dependent’s ability to need-based financial aid.

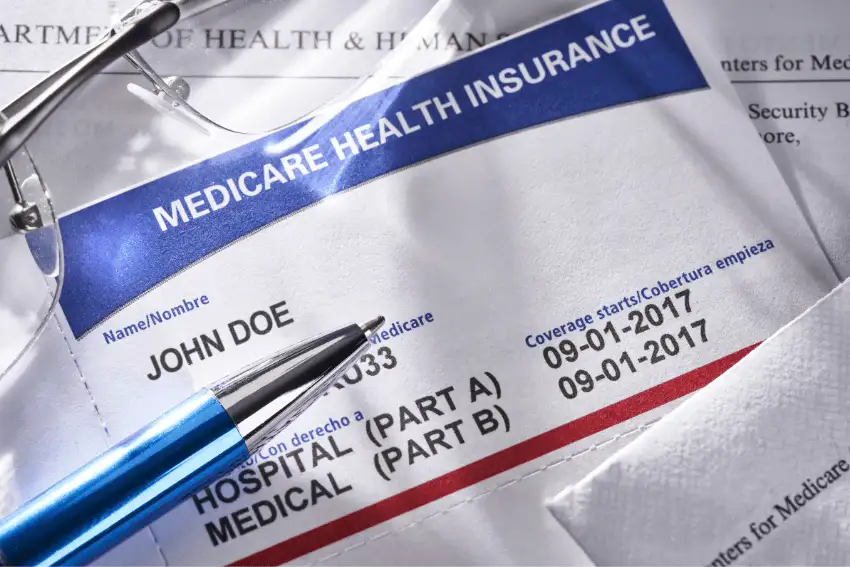

Medicare: The Basics of a Complex System

Sep 9, 2021 1:15:00 PM / by Jason Shaw posted in Financial Planning

Medicare is a federal health insurance program for individuals 65 and older, or younger individuals with certain health disabilities. Medicare is made up of 4 individual parts covering different aspects of a person’s medical coverage that come with varying costs. The individual parts can be combined to meet your healthcare needs. Most doctors take Medicare, but it is not a guarantee, so if you want to stay with your doctor and you’re nearing 65 it is a good idea to check with your doctor.

401(k): What is it and Why Should I Participate?

Aug 19, 2021 1:15:00 PM / by Jason Shaw posted in Financial Planning

A 401(k) plan is a retirement plan offered by employers to provide retirement benefits for their employees. Employees have the option to defer receipt of some of their wages until retirement. The contributions are pre-tax and made by the employees, with taxes paid when they are withdrawn in retirement. Most employers that offer 401(k) plans will also match your contributions. If your employer does match 401(k) contributions, you should contribute even if you are only able to set aside a small percentage of your salary. Not taking part in a 401(k)-match program is essentially giving away “free” money.

Should I Choose a High Deductible Health Plan?

Dec 8, 2020 11:15:00 AM / by Jason Shaw posted in Financial Planning

It’s fall, and that means open enrollment time for workplace benefits as well as Affordable Care Act (ACA) coverage. When you’re reviewing your health plan options, don’t overlook the benefits of a high deductible health plan (HDHP).

Now Is a Great Time to Meet with Your Advisor

Oct 6, 2020 2:15:00 PM / by Jason Shaw posted in Financial Planning, Investments

The COVID-19 pandemic has created financial stress for millions of Americans. In April 2020, a Harris Poll survey on behalf of Nationwide asked more than 2,000 adults in the U.S. about their COVID-related concerns. Overall, respondents’ top worries were being unable to pay their bills (45%), losing their life savings (33%), and losing employment (30%). Even those who enjoy more financial security are facing uncertainty. Among respondents with investable assets of more than $100,000, the top concerns were losing their life savings (41%) and inability to pay the bills (34%), afford healthcare (28%), or retire as planned (28%).